does td ameritrade report to irs

The IRS requires taxpayers to report interest of 10 or more earned on CDs but the rules arent always clear-cut. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt.

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Exchangelisted stocks ETFs and options.

. To start you must report any transactions first on Form 8949 and then transfer the info to Schedule D. Exchangelisted stocks ETFs and options. The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021.

Copy and paste this code into your website. Popular online brokerages with access to the US. The IRS specifically says that interest earned on bank accounts is taxable interest.

Online trade commissions are 000 for US. August 11 2022 By Robert Farrington. All interest income is taxable even if its not reported on a.

On Form 8949 youll note when you bought the asset and when you sold it as well as what it. After a municipality issues a tax lien. TD Ameritrade Singapore does not make any decisions on a new customers account until we have received all the necessary documentation.

If you own shares of TSLA on or before August 24 on August 25 you will receive 3 shares in exchange for every 1 you hold and the stock price will be reduced to one-third of its value. TD Ameritrade review. Make sure you are on track to meet your investing goals.

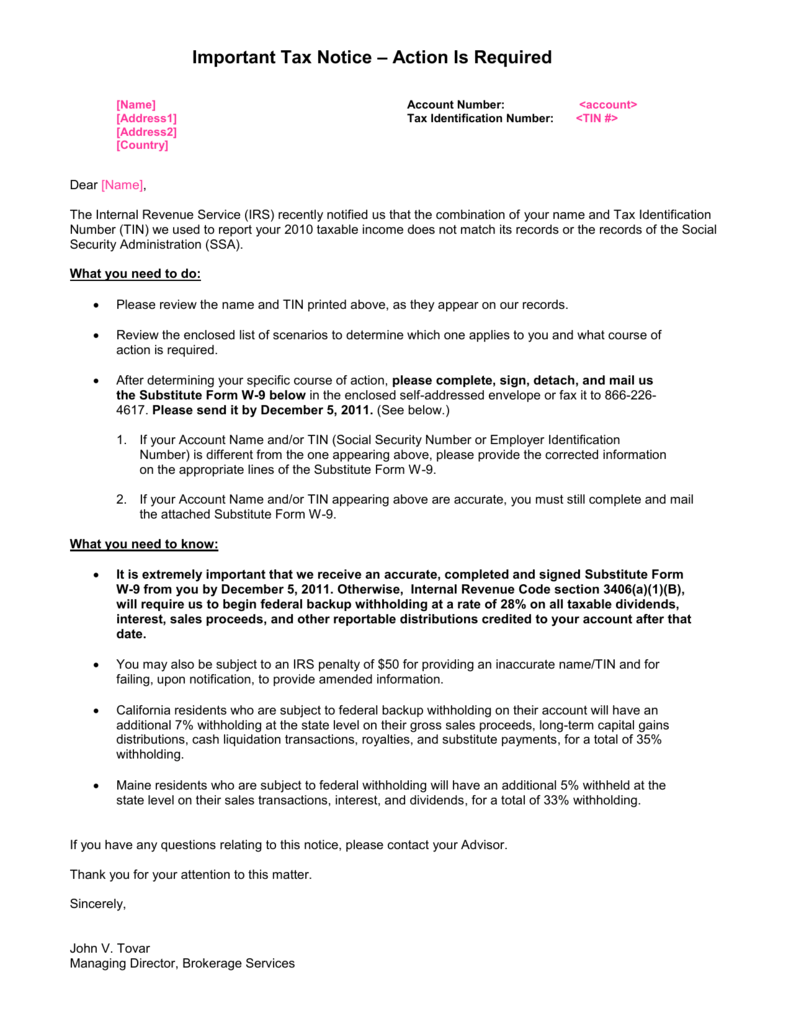

IRS to withhold 24 of all interest dividends proceeds from options transactions and. This brokerage has more than 175 locations around the country that you can walk into whenever you have a question you want to be answered in person. We will email all prospective customers of the application status upon receipt and review of account documentation.

Another brokerage firm that mixes online discount trades with brick-and-mortar locations is TD Ameritrade. Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts. Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts.

TD Ameritrade does not charge a fee for this type of a stock split. Common IRS Questions and Errors. The money beyond your initial team comes from your background PHB pp 125-14Are you playing 5e.

This means every dollar will be subject to income taxand the IRS will slap on an additional 20 penalty because you withdrew the funds for a non-approved purpose. Online trade commissions are 000 for US. Shares of IRS stock can be purchased through any online brokerage account.

A 065 per contract fee applies for options trades with no minimum balances on most account types. Select the TD Ameritrade account thats right for you. The best rewards credit cards make it easy to earn points miles and cash back without overspending.

A trustee-to-trustee transfer. Exchangelisted stocks ETFs and options. Online trade commissions are 000 for US.

Select the TD Ameritrade account thats right for you. The IRS sets a standard mileage reimbursement rate. What is the Millennial Age Range And What Does That Mean Financially.

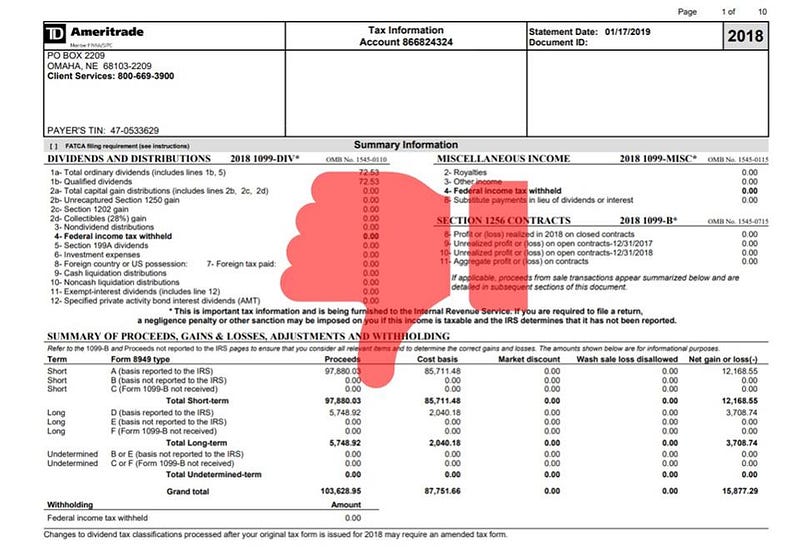

The Emergency Economic Stabilization Act of 2008 requires that brokerage firms and mutual fund companies report their customers cost basis and holding period on covered securities to the IRS on their Consolidated Form 1099s when securities are sold. Lori Kobel 29062022 1 minute read. If you dont report the cost basis the IRS just assumes that the basis is 0 and so the.

For most people retiring now the full retirement age for Social Security purposes. TD Ameritrade Review 2022. The Toronto-Dominion Bank TD or we has offered the Callable Contingent Interest Barrier Notes the Notes linked to the least performing of the shares of the iShares Russell 2000 ETF the shares of the Invesco QQQ Trust SM Series 1 and the shares of the SPDR SP 500 ETF Trust each a Reference Asset and together the Reference Assets.

Interest is usually taxed as ordinary income. Read our in-depth analysis of the top choices available from our partners. Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts.

IRS Tax Refund Calendar. This may result in multiple Forms 1099-R for the account. TD Ameritrade does not maintain or track loan balances.

Compare Top Brokerages Here. Their online trading platform is also easy to use. Heres what you need to know.

You can take a deduction for the business use of your personal car on Schedule C of IRS Form 1040. Stock market include WeBull Vanguard Brokerage Services TD Ameritrade ETRADE Robinhood Fidelity and Charles Schwab. TD Ameritrade Best for ETF Trading.

Select the TD Ameritrade account thats right for you. A 065 per contract fee applies for options trades with no minimum balances on most account types. The Notes are bail-inable debt securities as defined in the prospectus and subject to conversion in whole or in part by means of a transaction or series of transactions and in one or more steps into common shares of TD or any of its affiliates under subsection 39223 of the Canada Deposit Insurance Corporation Act the CDIC Act and to variation or.

Prior to 2011 firms such as TD Ameritrade reported only sale proceeds. A 065 per contract fee applies for options trades with no minimum balances on most account types. How do you know how much money you start in dd.

Early Benefits Shrank Your Social Security Check. For 2020 the federal mileage rate is 0575. When issuing a full distribution we are required to withhold 20 of the loan balance from the gross distribution amount and report the loan offset on IRS Form 1099-R.

For example if you owned one share and the price at market close on August 24 was 900.

Td Ameritrade Says I Made 196k In 3 Months R Tax

Deciphering Form 1099 B Novel Investor

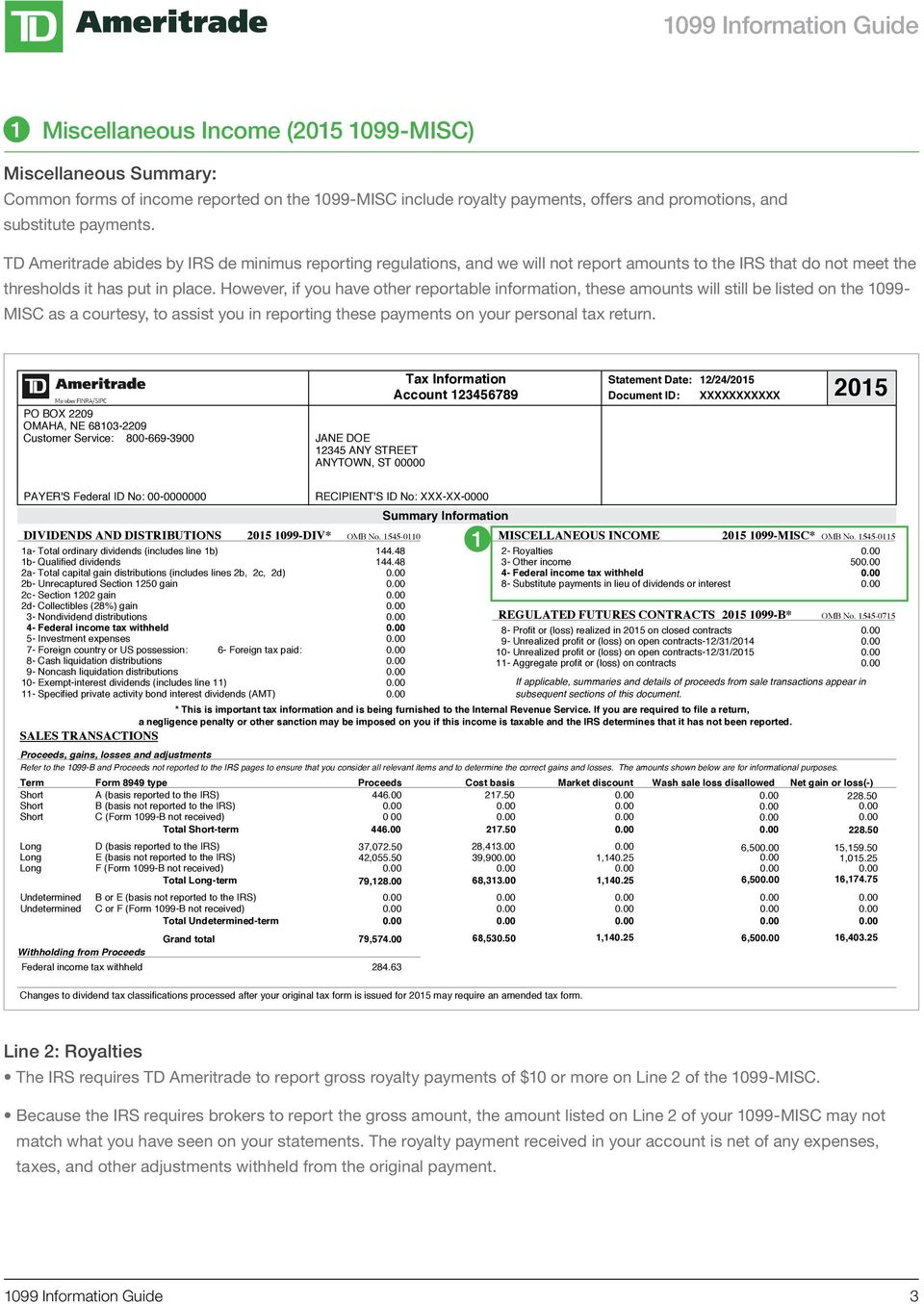

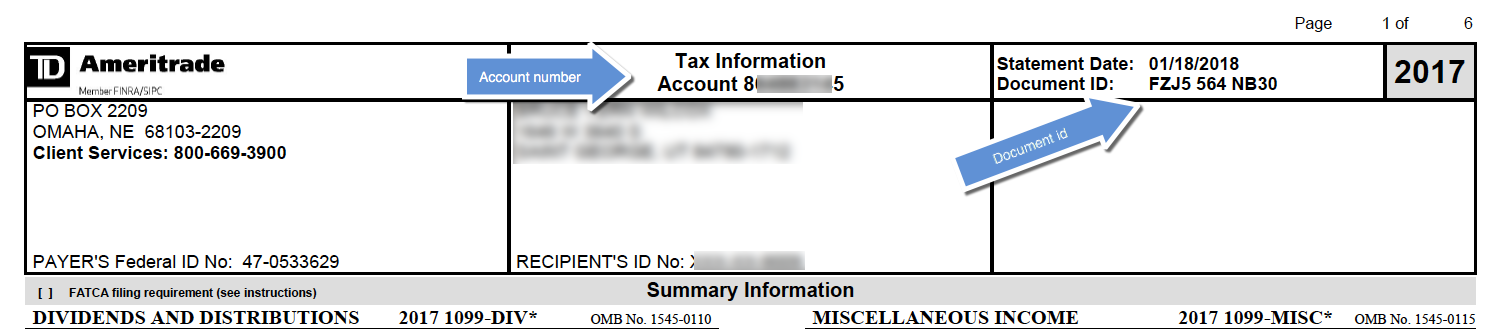

1099 Information Guide Pdf Free Download

Td Ameritrade Says I Made 196k In 3 Months R Tax

Logo Td Ameritrade Institutional

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Get Real Time Tax Document Alerts Ticker Tape

Td Ameritrade Ofx Import Instructions

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

How To Read Your Brokerage 1099 Tax Form Youtube

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman